Searching for the best CFD brokers in the UK to open a stock trading account can be a daunting task. With numerous options available, it’s crucial to find a reliable and reputable broker that suits your trading needs. This article explores the top CFD brokers in the UK, providing insights into their features, benefits, and what sets them apart.

What Are CFD Brokers and Why Choose Them?

- Understanding CFDs:

Contracts for Difference (CFDs) are derivative products that allow traders to speculate on the price movements of various financial assets without owning the underlying asset.

- Flexibility and Leverage:

CFD trading offers flexibility and leverage, enabling traders to potentially amplify their profits with a smaller initial investment.

- Diverse Asset Classes:

CFD brokers typically offer a wide range of asset classes, including stocks, indices, commodities, and currencies, providing ample opportunities for traders.

Key Factors to Consider When Choosing a CFD Broker:

- Regulation and Security:

- Regulatory Compliance:

Ensure the broker is regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK, providing assurance of fair and transparent trading practices.

- Investor Protection:

Look for brokers that offer investor protection schemes, such as the Best Cfd Brokers Uk Financial Services Compensation Scheme (FSCS), which safeguard clients’ funds in case of broker insolvency.

- Trading Platforms and Tools:

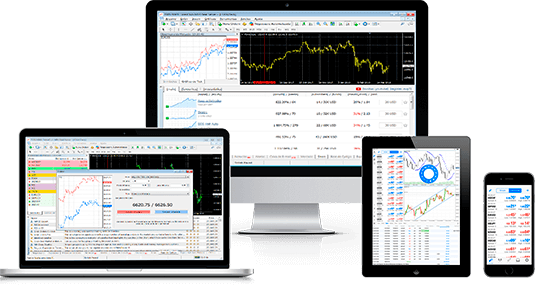

- User-Friendly Interface:

Opt for brokers with intuitive and easy-to-navigate trading platforms, offering advanced charting tools, technical analysis indicators, and risk management features.

- Mobile Trading:

Consider brokers that provide mobile trading apps, allowing traders to monitor their positions and execute trades on the go.

- Range of Markets:

- Stock Availability:

Evaluate the broker’s selection of stocks available for CFD trading, ensuring access to a diverse range of companies across various industries and sectors.

- Asset Diversity:

Look for brokers that offer a broad spectrum of CFDs, including indices, commodities, cryptocurrencies, and forex pairs, catering to different trading preferences.

· Costs and Fees:

- Spreads and Commissions:

Compare the spreads and commissions charged by different brokers, opting for competitive pricing structures with tight spreads and low transaction costs.

- Overnight Financing Charges:

Consider the overnight financing charges or swap rates applied to positions held overnight, as these can impact overall trading costs.

Top CFD Brokers in the UK for Opening a Stock Trading Account:

- IG Group:

- Established Reputation:

IG Group is one of the largest and most reputable CFD brokers globally, offering a comprehensive range of markets and competitive pricing.

- Advanced Trading Platforms:

IG’s proprietary platform and MetaTrader 4 (MT4) provide advanced trading tools, educational resources, and a seamless trading experience.

- Regulatory Oversight:

Regulated by the FCA in the UK, IG ensures compliance with stringent regulatory standards and client fund segregation.

- Plus500:

- User-Friendly Platform:

Plus500’s intuitive web-based platform and mobile app are suitable for both novice and experienced traders, offering a wide range of CFD instruments.

- Zero Commission:

Plus500 charges zero commissions on trades, with competitive spreads and no hidden fees, making it cost-effective for frequent traders.

- Robust Risk Management:

With risk management tools such as guaranteed stop-loss orders and negative balance protection, Plus500 prioritizes client safety and capital preservation.

- CMC Markets:

- Extensive Market Coverage:

CMC Markets provides access to over 10,000 instruments across multiple asset classes, including shares, indices, forex, and cryptocurrencies.

- Powerful Trading Tools:

CMC’s Next Generation platform offers advanced charting features, pattern recognition scanners, and customizable trading strategies, catering to active traders.

- Transparent Pricing:

With competitive spreads and no hidden fees, CMC Markets ensures transparent pricing and execution, enhancing the overall trading experience.

Conclusion:

Choosing the best CFD broker in the UK for opening a stock trading account requires careful consideration of various factors, including regulation, trading platforms, market coverage, and costs. By evaluating these key aspects and exploring top-rated brokers like IG Group, Plus500, and CMC Markets, traders can make informed decisions and embark on their trading journey with confidence.