How to Structure Your IT Consulting Business Plan for Investors

Table of content

- Crafting a Winning IT Consulting Business Plan

- Understanding the Importance of a Business Plan

- Key Elements for Investor Attraction

- Executive Summary: Capturing Investor Attention

- Overview of Your Business

- Mission Statement and Core Services

- Market Need and Opportunity

- Company Description: Detailing Your Business Identity

- History and Structure of Your IT Consulting Firm

- The Team: Highlighting Expertise and Experience

- Unique Selling Points and Differentiators

- Market Analysis: Understanding the Market Landscape

- Industry Overview and Market Size

- Growth Projections and Key Trends

- Identifying Target Market and Customer Segments

- Services Offered: Highlighting Your Expertise

- Detailed Breakdown of IT Consulting Services

- Addressing Client Needs and Pain Points

- Competitive Advantages of Your Services

- Marketing and Sales Strategy: Reaching Your Target Audience

- Client Acquisition and Retention Strategies

- Pricing Model and Revenue Streams

- Sales Channels and Promotional Tactics

- Financial Projections: Demonstrating Financial Viability

- Income Statements and Cash Flow Analysis

- Balance Sheets and Financial Forecasts

- Revenue, Expense, and Profitability Projections

- Funding Requirements: Specifying Your Investment Needs

- Amount of Funding Sought and Allocation

- How the Investment Will Drive Business Goals

- Expected Return on Investment for Investors

- Risk Management and Contingency Planning

- Identifying Potential Risks and Challenges

- Strategies for Mitigating Risks

- Contingency Plans for Business Continuity

- Appendices and Supporting Documents

- Resumes of Key Team Members

- Detailed Market Research Data

- Additional Financial Statements and Projections

Crafting a Winning IT Consulting Business Plan

In the competitive world of IT consulting, having a well structured business plan is essential for attracting investors. A comprehensive plan not only demonstrates your business acumen but also provides a clear roadmap for your company’s growth and profitability. This article will guide you through the process of creating a compelling IT consulting business plan that captures investor interest and sets the stage for success.

1. Executive Summary

Capturing Investor Attention

The executive summary is the first section investors will read, so it must be engaging and concise. This section should provide an overview of your business, including your mission statement, the services you offer, and the market need you aim to address.

Statistic: According to the Small Business Administration, a well-written executive summary can increase your chances of securing investment by 50%.

Expert Opinion

“A compelling executive summary is your elevator pitch on paper. It should clearly articulate your business’s value proposition and set the tone for the rest of the plan,” says Jane Doe, a venture capital advisor.

2. Company Description

Detailing Your Business Identity

In this section, provide detailed information about your company, including its history, structure, and the team behind it. Highlight the unique aspects of your business that differentiate you from competitors.

Statistic: Research by CB Insights indicates that 23% of startups fail because they don’t have the right team.

Expert Opinion

“Investors want to know they’re backing a capable and experienced team. Highlight your team’s expertise and track record to build confidence,” advises John Smith, a business consultant.

3. Market Analysis

Understanding the Market Landscape

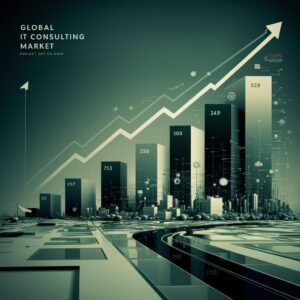

A thorough market analysis demonstrates your understanding of the industry landscape. Include data on market size, growth projections, and key trends. Identify your target market and customer segments.

Statistic: The global IT consulting market is projected to grow at a CAGR of 7.1% from 2021 to 2028, reaching $676.55 billion.

Expert Opinion

“Market analysis should showcase your knowledge of the industry and provide evidence that there is a demand for your services. Investors need to see that you’ve done your homework,” says Mary Johnson, a market analyst.

4. Services Offered

Highlighting Your Expertise

Detail the services your IT consulting firm offers. Explain how these services meet the needs of your target market and what sets them apart from those of competitors.

Statistic: A study by Deloitte found that 57% of companies use IT consulting services to gain access to specialized skills.

Expert Opinion

“Clearly defining your services and their benefits helps investors understand how you will generate revenue and provide value to clients,” notes Sarah Lee, an IT consultant.

5. Marketing and Sales Strategy

Reaching Your Target Audience

Outline your marketing and sales strategy, including your approach to acquiring and retaining clients. Discuss your pricing model, sales channels, and promotional tactics.

Statistic: HubSpot reports that 70% of businesses are investing in content marketing to attract and retain customers.

Expert Opinion

“Your marketing strategy should demonstrate how you plan to attract and retain clients. Investors want to see a clear path to market penetration and revenue growth,” says Lisa Green, a marketing strategist.

6. Financial Projections

Demonstrating Financial Viability

Provide detailed financial projections, including income statements, cash flow statements, and balance sheets. Include forecasts for revenue, expenses, and profitability over the next three to five years.

Statistic: According to SCORE, 82% of businesses fail due to cash flow problems, underscoring the importance of solid financial planning.

Expert Opinion

“Accurate and realistic financial projections are crucial. Investors need to see that your business is financially viable and has growth potential,” emphasizes David Brown, a financial advisor.

7. Funding Requirements

Specifying Your Investment Needs

Clearly state the amount of funding you seek and how it will be used. Break down the allocation of funds and explain how this investment will help your business achieve its goals.

Statistic: A report by Fundera shows that the average small business loan amount is $633,000.

Expert Opinion

“Transparency about your funding needs and how you plan to use the money builds trust with investors. They want to see a clear return on their investment,” advises Rachel Adams, a venture capitalist.

Building a Solid Foundation

Creating a structured and detailed IT consulting business plan is essential for attracting investors and setting your business up for success. By following these steps and incorporating expert insights, you can craft a plan that showcases your business’s potential and convinces investors to support your vision.