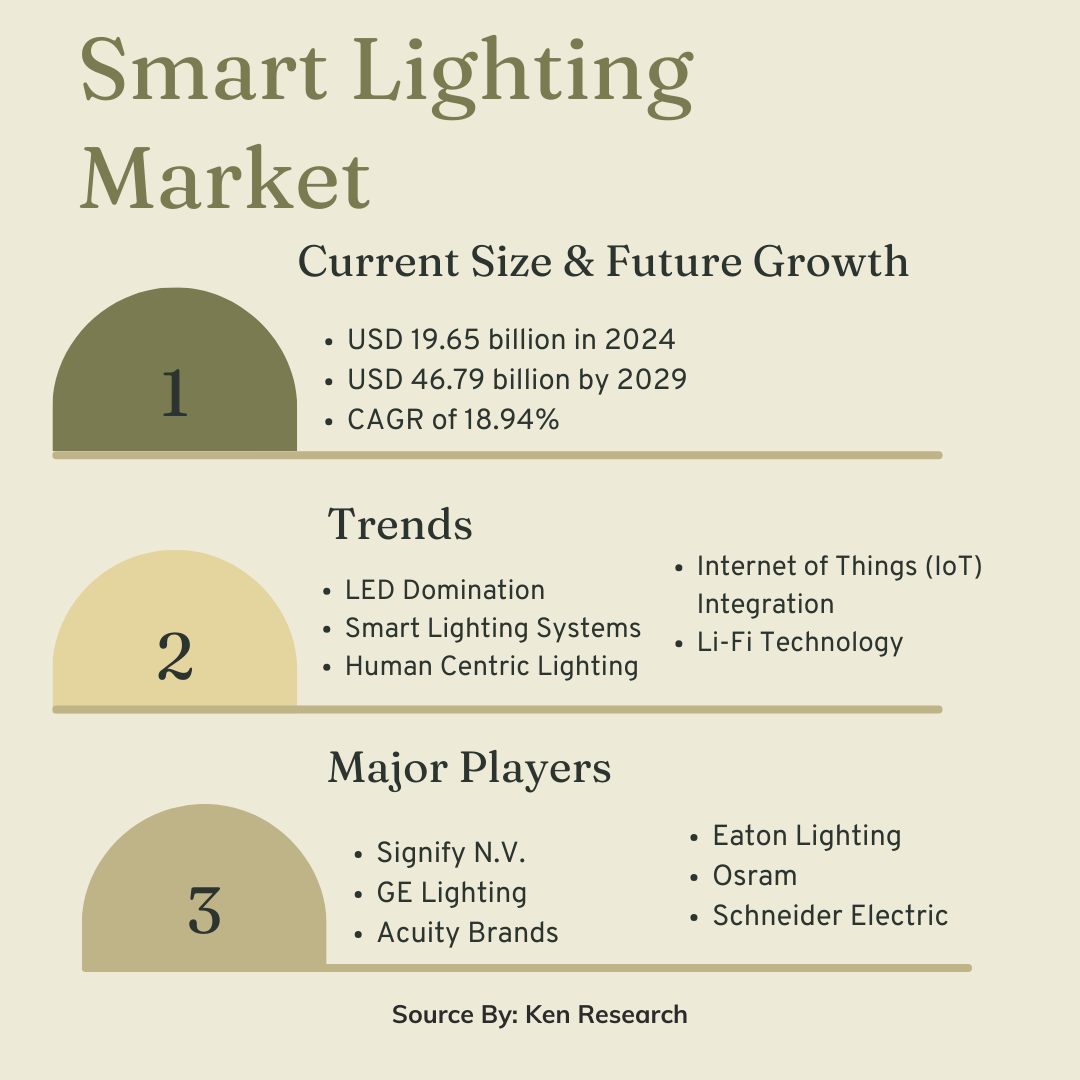

The smart lighting market is Size, with an estimated size of USD 19.65 billion in 2024. It is projected to reach USD 46.79 billion by 2029, growing at a CAGR of 18.94%. This growth is driven by the rapid adoption of energy-efficient LED technology, IoT integration, and favorable government regulations.

Key Trends in the Lighting Industry

The lighting market is undergoing a significant transformation, driven by advancements in technology, growing awareness of energy efficiency, and a focus on human well-being. Here are some of the key trends in the lighting market

- LED Domination: Light-emitting diodes (LEDs) are rapidly becoming the dominant lighting source due to their superior energy efficiency, long lifespan, and versatility. LEDs can be tailored to produce a wide range of colors and dimming capabilities, making them suitable for various applications.

- Smart Lighting Systems: Smart lighting systems integrate LED fixtures with sensors, controls, and software to enable remote control, automation, and data collection. This allows for features like scheduling, dimming, and occupancy sensing, leading to improved energy savings and user convenience.

- Human Centric Lighting (HCL): HCL is a lighting philosophy that prioritizes the impact of light on human health, well-being, and productivity. HCL lighting systems consider factors such as circadian rhythm, color temperature, and light intensity to create environments that promote alertness, focus, and relaxation.

- Internet of Things (IoT) Integration: Lighting is increasingly becoming integrated with the IoT, allowing fixtures to connect with other devices and building systems. This enables features like remote monitoring, real-time data analysis, and integration with smart home platforms.

- Li-Fi Technology: Li-Fi utilizes LED light to transmit data wirelessly at high speeds. This emerging technology has the potential to revolutionize wireless communication in indoor environments, offering a faster and more secure alternative to Wi-Fi.

Opportunities and Challenges in the Lighting Market

Opportunities

The trends shaping the lighting industry also present exciting opportunities for businesses:

- Energy Efficiency Solutions: Governments worldwide are implementing regulations that phase out traditional lighting and promote energy-efficient options like LEDs. This creates a significant demand for LED products and services, from manufacturing and installation to retrofitting existing buildings.

- Smart Lighting Market Growth: The smart lighting market is projected for significant growth due to its potential for energy savings, automation, and improved user experience. Businesses can develop and offer innovative smart lighting systems and controls for various applications like commercial buildings, offices, and homes.

- IoT Integration and Li-Fi: The integration of lighting with IoT and Li-Fi technology opens doors for new service offerings. Companies can develop platforms for remote lighting management, data analytics, and Li-Fi-based communication solutions.

pen_spark

Challenges

The lighting industry, despite the exciting opportunities, also faces some challenges:

- High Initial Cost of LEDs: While LEDs offer significant long-term savings due to energy efficiency and lifespan, the upfront cost can be higher compared to traditional lighting options. This can be a barrier for some consumers who might prioritize lower initial investment.

- Technical Expertise for Smart Lighting: Smart lighting systems require technical expertise for design, installation, and configuration. This can be a challenge for some consumers and businesses who may lack the in-house knowledge to implement these systems effectively.

- Standardization and Compatibility: The smart lighting market suffers from a lack of universal standards, leading to compatibility issues between different systems and manufacturers. This can make it difficult for consumers to create integrated lighting solutions using various products.

- Consumer Awareness and Education: Not all consumers are fully aware of the benefits of advanced lighting technologies like HCL or smart lighting. Educating consumers about the long-term value proposition and the impact on factors like energy use and well-being is crucial for wider adoption.

Major Players in the lighting industry

Here are some of the major players in the global lighting industry

- Signify N.V. (formerly Philips Lighting): A Dutch multinational company, Signify is a global leader in lighting solutions. They are known for their innovative LED lighting products and Philips brand recognition.

- GE Lighting: An American company, GE Lighting is a division of General Electric and a major provider of LED and traditional lighting solutions.

- Acuity Brands: An American company, Acuity Brands manufactures and distributes a wide range of lighting products under multiple brands, including Lithonia Lighting, Holophane, and Aculux.

- Eaton Lighting: An Irish-American company, Eaton Lighting offers a variety of lighting solutions for commercial, industrial, and residential applications.

- Osram: A German multinational company, Osram is a leading provider of lighting products, including traditional lamps, LEDs, and optoelectronic semiconductors.

- Schneider Electric: A French multinational company, Schneider Electric offers a range of electrical products, including lighting solutions for various applications.

- LG Innotek: A South Korean company, LG Innotek is a major manufacturer of LED components and lighting solutions.

Segmentation in the Lighting Sector

The lighting market can be segmented in several ways to understand different categories of products, applications, and consumers. Here’s a breakdown of some key segmentation factors:

By Light Source

- LED (Light Emitting Diode): Dominant segment with high growth due to energy efficiency, long lifespan, and versatility.

- CFL (Compact Fluorescent Lamp): Maturing segment being phased out in favor of LEDs.

- LFL (Linear Fluorescent Lamp): Commonly used in offices and schools, but facing competition from LEDs.

- HID (High-Intensity Discharge): Used in industrial and outdoor applications, but being replaced by LEDs in some cases.

- Halogen: Primarily used for accent lighting and task lighting due to short lifespan and lower efficiency compared to LEDs.

- Incandescent: Traditional lighting source, but phased out in many regions due to low efficiency.

By Application

- Indoor Lighting: Largest segment, encompassing residential, commercial (offices, retail), and industrial applications.

- Outdoor Lighting: Includes streetlights, parking lot lighting, and landscape lighting.

- Automotive Lighting: Headlights, taillights, and interior lighting for vehicles.

By End-User

- Residential: Lighting for homes and apartments.

- Commercial: Lighting for offices, retail stores, hotels, restaurants, and other commercial spaces.

- Industrial: Lighting for factories, warehouses, and other industrial facilities.

- Government: Lighting for public spaces, streets, and government buildings.

By Technology

- Standard Lighting: Traditional lighting products without advanced features.

- Smart Lighting: Lighting systems with integrated controls, sensors, and connectivity for automation and data collection.

- Human Centric Lighting (HCL): Lighting designed to mimic natural light patterns and optimize human health and well-being.

- Connected Lighting: Lighting integrated with the Internet of Things (IoT) for remote control and data analysis.

Conclusion

The lighting sector, particularly the smart lighting segment, is poised for substantial growth in the coming years. Technological advancements, regulatory support, and increasing consumer demand for smart home solutions are key drivers. However, challenges such as market entry barriers and regulatory compliance need to be addressed to sustain this growth. Major players in the industry are continuously innovating, ensuring a dynamic and competitive market landscape.